Small business owners face many challenges, and taxes are probably at the top of the list.

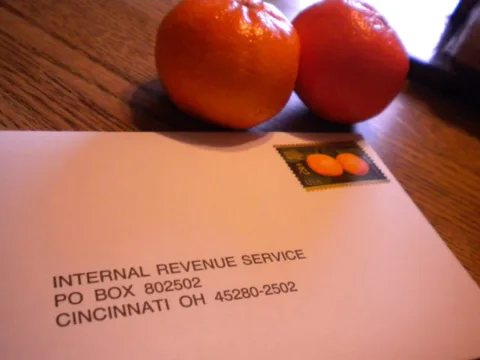

If you’ve been self-employed, then you know all too well the devastation that can come with an IRS audit.

While big companies often build audit costs into their budgets, small businesses are especially vulnerable to being blindsided by an audit. As a small company, you don’t have the big legal staff to ward off the IRS, and you can lose out on significant productivity while the audit is taking place.

Being audited can be an expensive and frustrating experience. Your best approach is to avoid encounters with the IRS altogether.

Even if the audit is harmless and the small business is doing the right things, going through the audit investigation represents an unnecessary cost.

Here are 5 ways to prevent an audit, if you’re a small business owner:

#1 – Don’t fluff your travel expenses.

Big businesses often have major travel expenses to account for. The IRS understands that big corporations need to send their people far and wide to make deals.

However, if you own a small store in town, you’re unlikely to have major travel needs.

Claiming a trip to San Francisco with the family as a business expense is a great way to find yourself under the pressure of an audit. The risk isn’t worth the reward when it comes to fluffing your travel expenses.

#2 – Keep clearly defined business accounts.

Nothing good comes from co-mingling finances between your personal and small business bank accounts.

This can be tempting to do, of course. As a small business owner, you are constantly shifting money in and out — depending upon your changing needs.

Doing this raises a red flag though, and it can make your business bookkeeping especially sloppy.

If you want to avoid an audit, keep your business bank account solely for business use and your personal bank account for the things that you buy for yourself, your family, and your home.

#3 – Don’t overdo your charitable donations.

Giving to charity is a great way to signal to the community around you that you are in business for more than just money.

It has some tangible benefits in terms of sales, brand building, and visibility. However, going too far with your charitable claims can cause an audit.

The IRS has tremendous data to let them know precisely how much people in your position often give. If you claim more, then you may trigger their system.

Even if you’re able to justify these expenses in an audit, you’ll have to endure the hassle of answering questions and potentially paying a tax lawyer.

#4 – Reconsider claiming a home office and a real office.

As a small business owner, you may work from a combination of spaces. You might do some work from home and then head to the office to hold a client meeting.

If you have a standalone business office, you may be tempted to claim a deduction for the cost of your home office space as well. While this may be true and totally legitimate, just know that doing so might trigger an IRS audit.

The IRS understands that people often lie about having a home office in order to keep down their cost of living. This punishes all small business owners — because you can fall under IRS suspicion even if you’re doing the right thing.

On the other hand, if you work solely out of your home and conduct all of your business there, then a home office deduction is clearly justified.

#5 – File your tax returns on time.

As a small business owner, you might be inclined to delay filing your taxes due to a concern over cash flow issues. Thankfully, there are alternative financing options to help you cover these expenses if necessary.

Although filing taxes can be burdensome and resource-draining for a small company, it’s still something that you should get out of the way as soon as possible.

Consistent late filing of tax returns and late payment of taxes sends a big red flag to the IRS.

Failing to follow tax filing requirements and meet tax deadlines triggers penalties, interest, and unwanted attention. Always ask for an extension if you won’t be able to meet a deadline — to avoid being audited by the IRS.

Bottom line — you want to do everything in your power to keep the IRS from looking into your finances.

Doing so requires that you understand the red flags and avoid triggering the IRS’s investigative system surrounding these issues.

Helpful Resources Regarding IRS Audits

- What The IRS Audit Process Is Like

- How To Get IRS Tax Help

- What To Expect If You’re Audited

- How Often Do Small Businesses Get Audited?

- How To File & Submit Your Tax Return

My very first job after college was as a Career Counselor — helping college graduates choose their ideal career and plot a course toward their dream job. Ever since then, I've been helping others streamline the job search process — by focusing only on what's most important and ways to stand out from other job candidates. As an entrepreneur myself who works from home full-time, I'm especially passionate about helping others fulfill their entrepreneurial dreams. When I'm not helping people find ways to get paid doing what they love, you'll find me at the corner of Good News & Fun Times as publisher of The Fun Times Guide (32 fun & helpful websites).